If you’ve filled up your car this week, you may have noticed some slight (emphasis on slight) relief at the pump. The national average of gas prices is dropping. For those living in the southeast, the prices have fallen at or below 4 dollars in most of the southeastern states — something we haven’t seen since the spring. I’d say the cost of gas is a good metaphor for what we’re seeing in terms of cost and market conditions in our industry. While costs aren’t dropping back to pre-pandemic prices, we’re cautiously optimistic watching the cost of some materials dropping that the worst of the rapid escalation might be over.

Signs of Stabilization

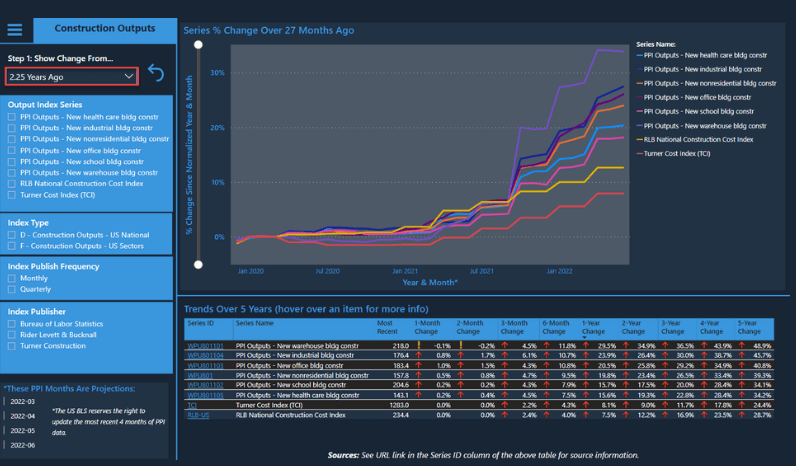

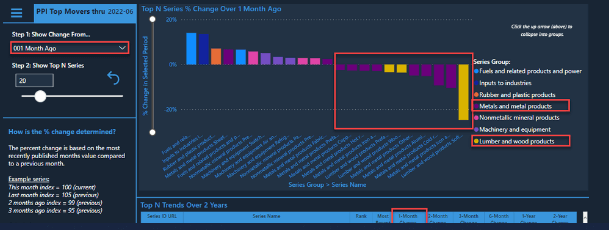

Our Preconstruction department tracks and studies the Producer Price Index (PPI) data from the Bureau of Labor Statistics so we can provide accurate cost data to our clients and project teams. This month appears to be a mixed bag in terms of construction-relevant material costs. For the most part, it’s primarily finished good prices that are on the rise. However, there are some promising signs that raw material prices are beginning to improve. Energy and transportation prices are still much higher than 2-3 years ago but might be beginning to ease.

While we do expect to see relief on raw prices in the future, there will likely be a delay in seeing the impact from falling raw prices on finished prices. Because there has been so much uncertainty for so long, manufacturers will most likely hang on to the current increased prices until competition pressures them to change. It is important to note that labor costs have also increased over this time frame to account for general inflation and increased wages has been used as a recruiting mechanism as the construction labor pool was made smaller by the pandemic through illness and early retirements. Once the labor component of any industry increases it is very unusual for it to come back down.

Rising interest rates are likely already impacting new home construction and renovations, that could already be impacting lumber. All of us in the design, construction, development, and facilities management industries will be closely watching the federal government’s interest rate adjustment over the coming months in hopes that they can calm the market without quenching it.

Breaking Down the Data

Not surprisingly, the biggest area of increase in the last 6-months has been in energy / petroleum products (see the light and dark blue categories in the chart below). Unfortunately, this also impacts the mining, manufacture, transportation, and in many cases the raw materials themselves for many construction products.

The dark purple in the chart below represents metal products. Note that some are up, and some are down over this last month. Materials that were trending upward over this period appear to be in the final stages of production. Whereas we’re seeing downward trends in the cost of steel coils which serve as raw material for metal studs, equipment housings, piping, ductwork, etc.

In the same chart above, you can see Lumber (in yellow) is also on a downward trend the last few months. There could be more relief on the way in the form of reduced US-Canada lumber tariffs. According to the AGC, this tariff is set to be reduced by more than 6% effective August 2022. This tariff was doubled in November 2021.

Both metal and lumber products still have a long road ahead to get anywhere back to pre-Covid territory. Despite these recent decreases, most lumber products are still 100% more than March 2020. While metal products are still 80% – 160% more than March 2020.

So, while costs are only down in comparison to their peaks just a few months ago, we are seeing some signs of stabilization. Which, stability would be a welcome relief to our industry as developers and project teams have been dealing with unprecedented levels of uncertainty in the market and supply chain for the past two years. I believe the project teams that have successfully delivered projects through early preconstruction, planning, and procurement efforts will be able to take the slightly changing tide and bring a refreshingly increased level of predictability to clients in terms of estimating and project planning.