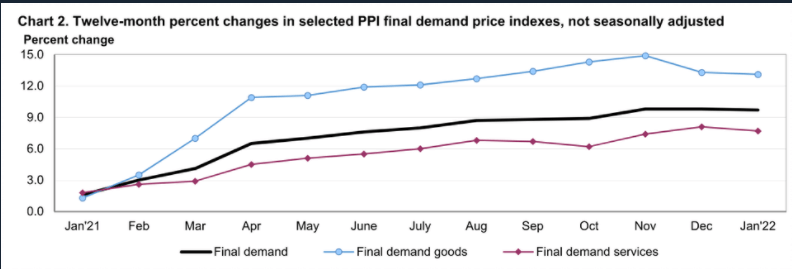

The US National Producer Price Index for January 2022, which includes data for all industries – not just construction, indicated an overall final demand cost increase of 9.7% from January last year. That’s the same rate reported from December 2020 to December 2021. Final demand is the stage in the supply chain where finished products and services reach the consumer. This nearly 10% overall increase is composed of a 13% jump in goods and materials (primarily material manufacturing industries) and an 8% jump in services and labor.

January projections marked another significant rise in the final demand construction group. After a relatively flat first quarter in 2021, these new construction indicators rose between 12% and 28% depending on the project type and associated materials. Warehouse projects were impacted most severely due to the typical high percentage of contract value tied to volatile materials like steel. Whereas school construction was on the lower end of the change since these projects typically rely heavily on concrete and masonry — which have been on the lower end of cost impacts over the last 12 months.

Design Activity

We are also tracking data from the Architectural Billings Index (ABI) which is a good predictor for construction activity about 6 to 9 months ahead. Specifically, we are tracking how often design firms are getting inquiries about new projects, how much work they are signing up to design, and how much they are actually billing for work performed. All these series are based on a neutral axis of 50. Anything above 50 represents a favorable market (to the AEC industry) and anything below represents an unfavorable market.

As of January 2022, here is what’s being reported:

Design Inquiries: 61.9 (+11.9)

Design Contracts: 56.1 (+6.1)

Billings: 51.0 (+1.0)

The Southern U.S. region had the highest billings index of 61.2, indicating the Southern U.S. has the most design work of the four regions, and has had the most stable demand and recovery in this post-COVID industry.

Construction Materials

Here are some updated trends on common materials:

Lumber

Lumber reached its 3-year peak back in May 2021. In fall of 2021, it was common to hear talks of falling lumber prices. That happened but was very short-lived. Lumber commodity pricing is currently tracking around 250% above pre-pandemic prices. Futures for the remainder of 2022 show no indication of returning to pre-pandemic pricing.

Hot-Rolled Coil Steel

This steel products commodity used in a wide variety of construction and manufacturing industries hit an all-time high in 3rd Quarter 2021. Pricing is roughly double pre-pandemic pricing. Steel has been trending down in price since October 2021. It appears scrap steel pricing has dropped mildly in recent months but is still much higher than two years ago. However, mined ore has increased. We could be seeing some price reduction here due to automobile manufacturing issues related to semiconductor/chip shortages. The auto industry consumes more scrap steel than any other – about 14 million tons per year.

Copper

Copper continues at a stable rate, but still about 70% higher than pre-pandemic.