In the first few weeks after the onset of COVID-19, it seemed like every other house in my neighborhood had some type of home repair project going on — from new decks to full-scale additions. Between the shift towards working remotely and the need to social distance, people found themselves at home a lot more. What better time to tackle some of those “around the house” projects that have been lingering on to-do lists? The increase in home improvement projects is one factor that has driven the price of lumber to a record high —a nearly 50% increase since the pandemic started. Wood has traditionally been an affordable and reliable material, so what does this recent surge in cost mean for commercial development projects?

Sudden Changes in Supply and Demand

Let’s go back to the beginning of the COVID pandemic in the United States. At first, construction temporarily came to a halt. Demand of lumber was down, so the prices started falling. Lumber mills decreased production and some even laid off workers to avoid building a surplus of materials they couldn’t sell. What they couldn’t anticipate, was the sudden boom of home improvement projects. In addition, interest rates decreased which motivated people even further to add onto existing homes or build new ones. Those factors combined caused a rebound effect, and the wood demand spiked.

Prices Soar

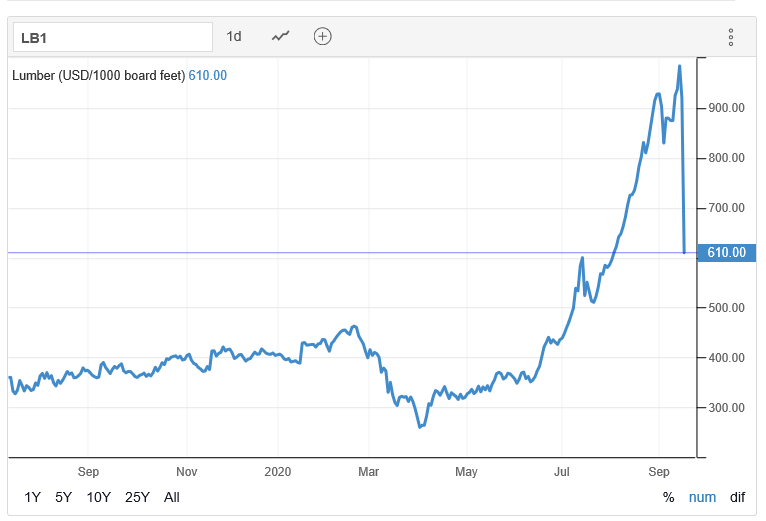

With demand aggressively rising, the lumber mills had to scramble to get production back online and there were a lot of factors making that difficult. They had to hire back laid off workers or find replacements for those who had gotten new jobs. Like everyone, they had to implement increased health and safety measures and shut down their operations if there was a COVID outbreak. As mills were trying to catch up to demand, we also saw big supply chains put in huge orders for lumber. In short, the supply is limited and hard for independent contractors to get their hands on — a perfect recipe for a price surge. To really put it in perspective, in April lumber dropped to around $260 per thousand board feet. In mid-September, those prices closed at $948 per thousand board feet.

Image Source: Trading Economics

Wood vs. Steel, Price Gap Narrows

So, what does all this mean for commercial developers? Owners building midrise multifamily, student housing, or senior living projects, for example, usually have to choose between wood framed or metal stud. Pre-COVID, wood was the more affordable option for owners looking to stay under budget. Choosing steel came at a premium. Now, however, the two materials are far closer in cost. Metal stud prices haven’t necessarily dropped, but lumber prices have increased significantly, closing the price gap between these two building products. Given that steel is a more durable material, it could be worth the slightly higher cost in order to get the premium product.

Looking to the Future

In addition to the record-high cost of wood, developers also need to consider how unpredictable the material’s prices and availability have been. In our industry, predictability is an asset. It allows owners to be confident in their budgets and schedules. In the past, lumber has been a relatively predictable and less volatile material to choose. Readily available at a steady, low cost. But given the current conditions, wood is fairly volatile and can be a risky materials choice for projects. The costs are high and could rise again, the demand is increasing, and the supply remains low. So, if you have the choice between wood frame and metal stud, steel could be the safer bet right now.

Some research is predicting lumber prices could drop a little as we head into autumn and winter months. But if we’ve learned anything in 2020, it’s that nothing is certain. The forest fires out west could certainly impact the lumber supply. As could hurricane relief, with people looking to rebuild and repair their storm-damaged homes. I think we can safely assume that wood will remain a volatile material, at a higher price than we’re used to, for the foreseeable future.