We’ve all heard the stories. Bidding wars. . . zero inventory. . . no inspections. . . as-is conditions . . .

Even if you aren’t participating in the single-family home buying frenzy, it’s hard to ignore the challenges facing potential homebuyers. I’m speaking from my experience in Nashville. Prices in every neighborhood have gone to the moon and I hear one jaw-dropping anecdote after another from my real estate agent friends. There are similar trends in each area of the country we serve. If you are moving to the Sunbelt, good luck. There isn’t anywhere to live. So, what does this mean for the commercial construction industry? The conditions that make house hunting a nightmare are the same ones keeping the multifamily construction market booming. 2021 was defined by an abundance of cash in capital markets, significant migration trends, and urban revitalization. In our markets, these factors came together to drive a demand for multifamily construction that is showing no signs of letting up.

Demand Driving New Development

A recent report from RentCafe suggested construction of multifamily rental properties has maintained the same pace for four years, despite the pandemic. In 2021 alone, for the 5th year in a row, more than 330,000 apartments are expected to be delivered across the country. The multifamily demand is especially high across the Sunbelt. Dallas, Houston, Austin, Atlanta, Charlotte, Orlando, Tampa, and Raleigh all grace the top the list with the most new rental units.

Think about that growth for a minute. In 5 years, more than 1.65 million new apartments have become available for rent in the U.S., and new projects are breaking ground all the time. When the pandemic hit, we expected construction to come to a screeching halt, but the opposite happened in the multifamily world. Development had to keep pace with significant population migrations. Many individuals realized they could essentially work from anywhere and packed their bags and boxes for a fresh start. Corporations fled states with higher taxes and relocated to those with more favorable climates (both kinds) like Florida, Texas, and Tennessee. Some cities, like Orlando, saw a surge of people relocating from the coasts. With money to burn, these buyers drove up the cost of the existing inventory, making renting a much more favorable, and often only, option for everyone else. As demand rose, apartment rental rates correspondingly followed, making previously dead multifamily deals spring back to life in key markets. Suddenly, the math works.

I’d be lying if I told you we saw this coming two years ago. What we did see is the continued growth in the markets we proudly call home. Austin, Nashville, Orlando, Atlanta, Birmingham, Chattanooga, Houston, Dallas, Charlotte, and Raleigh are all places where people want to live and work and that’s not going to change anytime soon. As we enter a new phase of Fed policy and corona variants continue to drop, uncertainty abounds. We are confident in where we are and our ability to navigate whatever challenges come next. Today, business is booming, and residential development companies are as busy ever.

New Trends in the Market

The desire to greenlight for-rent product is not the only trend we see. More and more developers are considering luxury condo projects as well. Four years ago in Nashville, new condo projects were essentially non-existent. These units demand high-end appliances, cabinets, finishes, sound control, and plush amenities to compete with single family residential homes and require a greater tolerance for risk and capital. You get one chance to sell these units and if you don’t hit your projections— your ROI is shot. For the brave few that rolled the dice, it’s paying off handsomely. Condo sales are strong, and these projects continue to deliver. There is a desire for second homes, investment properties, and generally an increased appetite to live in a walkable, urban environment. Due to the lack of single-family inventory, condos are acting as a relief valve for that supply issue.

Keeping Projects Profitable

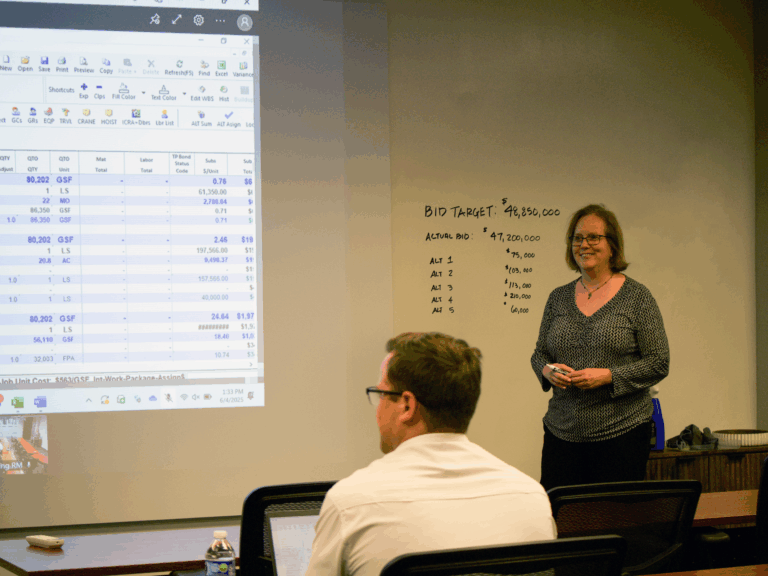

In past posts, we’ve talked a lot about escalating construction costs and supply delays that are creating challenges for projects and budgets. Multifamily projects are especially at risk in an unstable market due to the massive amount of materials required to build out hundreds of residences at once — from doors to windows to faucets and cabinet hardware. If it’s not hard to get, you probably can’t find anyone to install it. This combo is driving historically high prices construction prices. If the specified doorknobs have a supply issue and are now impossible to get, it could derail the project schedule while we wait on 860 doorknobs because a spring isn’t available for 6 months. The solution? First, pick a new doorknob. After that, you should strongly consider choosing your contractor as the design phase begins. We are constantly pricing every piece of these projects, monitoring price fluctuations, material availability, hearing horror stories, telling a few of our own, and maximizing relationships with the subcontractor and vendor community to sort it all out. An experienced builder can work in tandem with the design team to check material availability and offer alternative solutions for the finishes or appliances that are harder to get or will send your project overbudget. In addition, it is critical to lock in prices and order materials well in advance to stay on target.

It’s a great time to be in the multifamily development business, but if your project isn’t properly planned with materials and supply chain issues in mind — it could threaten your returns. An experienced builder and design team partnering together can deliver a project that will still get your desired rent rates while staying within budget.