According to the Bureau of Labor Statistics (BLS), and our own experience, construction materials made a striking upward shift in price over the last 12 months. Many sources indicate this increase has been 15%-20% in just a single year. The fact construction is getting more costly may not be shocking news, our industry and our clients have been feeling the effects of rising construction costs for over a year now. We’ve been closely monitoring the impact the fluctuating prices of essential construction materials like lumber and steel has had on our industry. But by the end of summer, there seemed to be some good news with overall construction costs showing far less dramatic increases. In fact, we even saw some significant cost decreases in a few categories like dimensional and engineered wood products (framing lumber, plywood, trusses, glue-lam). Despite that positive news, it should not be treated as a long-term return to normal for wood products. Lumber futures have been trending upward again over the last couple of months ($800-$900) likely based on US-Canada lumber tariff speculation. Still, this is roughly half of the May 2021 spike which capped out at $1,700. For reference, pre-pandemic lumber futures hovered between $350-$400 for all of 2019. Unfortunately, metallic products (steel, copper, aluminum) and petroleum-based products (fuel, plastics, some types of insulation, etc.) have shown no signs of returning to normal any time soon.

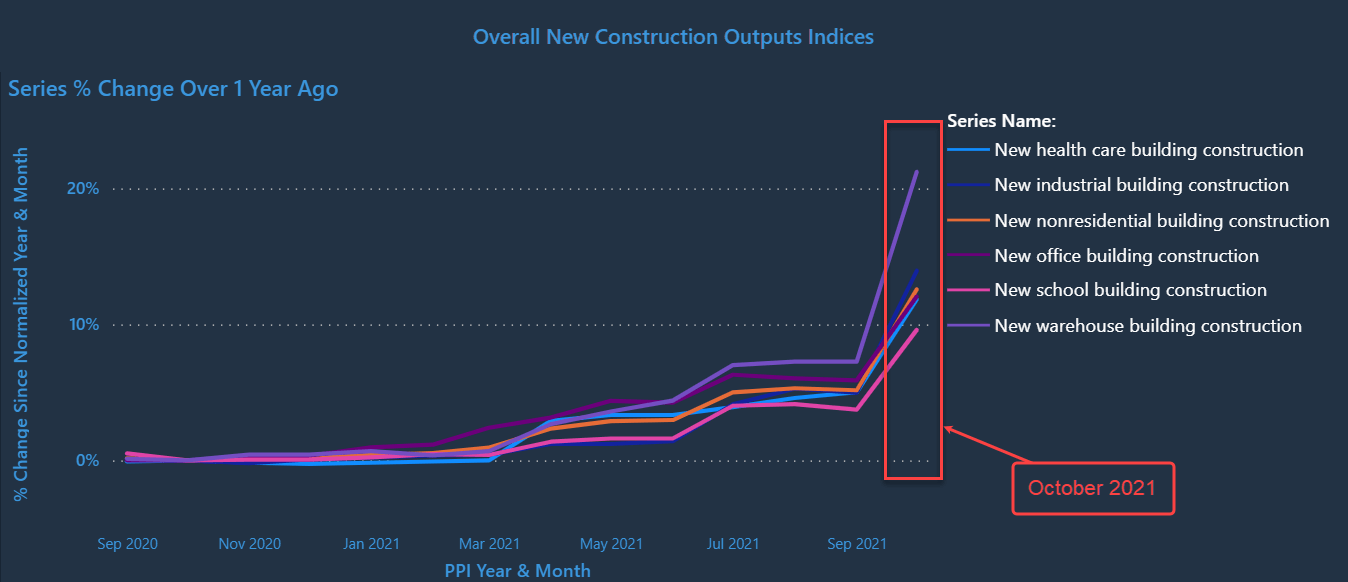

While many material cost indices such as the PPI have been portraying these material increases in timely fashion, very few have been showing the resulting impact on overall construction costs.

Then, the BLS issued its October 2021 projections for new construction.

Preliminary projections for October show a whopping single-month leap of roughly 7%. That kind of jump is typically representative of a 15-to-18-month period.

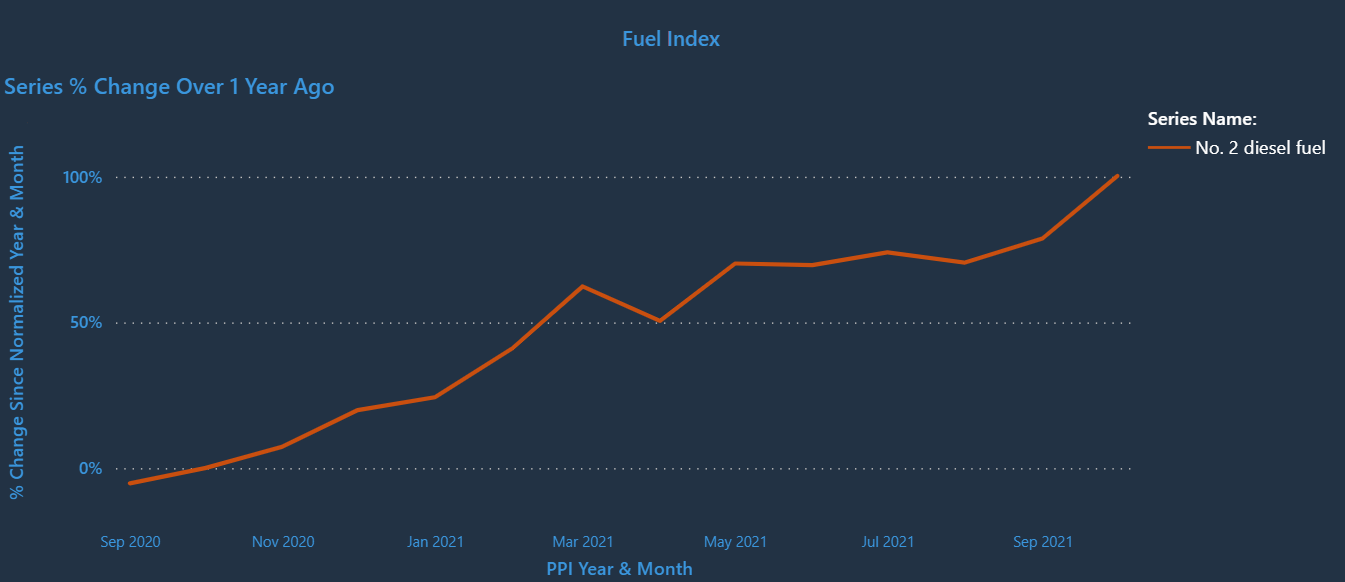

So, what’s behind the sudden surge in construction costs? In short, continued supply shortages and delivery delays, especially those shipped from overseas. Steel continues to be a volatile material. And steel rears its head in a lot of different critical trades on a project — reinforcing steel in concrete, metal stud framing, structural steel, door frames, ductwork, etc. We’re also having trouble securing anything made out of plastic like plastic conduit, plumbing and utility piping, and membrane roofing materials. And of course, we can’t forget about the rising cost of fuel which impacts everything on a construction site from temporary power, to material deliveries, to fueling construction equipment. #2 Diesel has doubled in price in the last 12 months and all forms of energy used in construction is up on average 77% in 12 months.

I expect projects beginning in this final quarter or in early 2022 will continue to feel these price increase. We haven’t seen overall project costs increasing as fast as the material pricing suggests, but that is most likely due to projects already being priced with agreements and contracts in place. Trade partners can’t absorb this degree of cost increases, so prices must rise in return. Right now, most steel prices are only good for 24 hours. That’s how quickly their prices changes based on fluctuating costs.

It should be noted these numbers from the BLS are preliminary projections (they reserve the right to adjust over the next 4 months). However, based on the last 6 months of observations, the BLS typically only makes minor adjustments in subsequent monthly updates.

So, how can developers protect their budgets from inflating out of control in 2022? What is working best for our company is to secure the key volatile trades up front and as early as possible. Securing the steel package first. Locking in roofing contractors and ensuring they buy enough roof membrane. The lead time on these products have a severe impact on construction schedules, so contractors need to incorporate longer preconstruction periods than ever before to manage the schedule. For example, where we used to be able to secure roofing materials 6 weeks out, we now need to have the trade partner locked in and materials ordered 9 to 12 months or more in advance. To learn more about how early contractor involvement can make these unpredictable times in our industry more predictable, here’s 3 of our top articles: