We all know everything is more expensive right now, so let’s agree that rising prices and the ongoing volatility in the supply chain I’ve written about for the past two years aren’t news anymore. While this has created challenges in our industry (in some market sectors more than others), construction overall continues to be a story of growth. Earlier this year, the construction industry in the U.S. was forecast to grow by 8.8% in 2022. Judging by how many ongoing projects there are in the country and by how many new proposals our company gets each week, I think it’s safe to say that projected growth is still happening. What I would like to focus on is some of the evolution we’ve seen within a few of the most active markets. Mainly, the healthcare, higher education, and multifamily markets — which are all seeing continued construction activity driven by population growth and migration.

Multifamily

The market most impacted by population shifts and growth is multifamily. The number of people in cities across the southeast is growing. We’re seeing substantial population booms in both the major metros like Dallas, Orlando, Atlanta, and Nashville, as well as some of the mid-size cities like Chattanooga. A large part of that migration is driven by corporations who are moving headquarters and employees to these areas.

People moving to a new city need a place to live. Single-family homes are in low supply and high in cost, making them unattractive or even unattainable. The alternative is multifamily, and developers simply can’t build new luxury apartments fast enough to keep up with the demand. 2021 was a record year for new apartment construction, and 2022 is slated to top it. More than 426,000 apartments are currently under construction and expected to be completed this year —the highest amount in at least 40 years. The multifamily demand is especially high across the Sunbelt. Dallas, Houston, Austin, Atlanta, Charlotte, Orlando, Tampa, and Raleigh top the list with the most new rental units.

All that growth and demand has led to a new trend within the market, an increased production of new luxury condo projects. Several years ago, new condo projects were virtually non-existent in most of the cities listed above. These units demand high-end appliances, cabinets, finishes, sound control, and plush amenities to compete with single-family residential homes. In the past, the risks associated with for-sale condos were too high and developers opted for rental units instead. However, as we already covered, the single-family real estate market is tough. For people who want to own their own home while being able to enjoy an urban walkable lifestyle, condos are a great option. Condo sales are strong right now and these projects continue to be greenlit. In addition, due to the lack of single-family inventory, condos are acting as a relief valve for that supply issue.

Higher Education

The higher education market is mirroring the residential one in a lot of ways. Student population is also increasing at schools across the country, and there is an increased need for more on-campus student living. According to a report by Dallas-based architect Humphreys and Partners Architects, the higher education sector will have to build 45,000 beds by the end of this year to keep up with the growing demand. As schools plan new residential projects, we’re seeing similar design trends from the multifamily market being incorporated — increased walkability to dining, social, and learning facilities, luxury amenities like rooftop pools, social lounges, and on-site retail and dining, and private bathrooms in every room.

With growing student populations, comes the need for expanded and improved facilities. We’re seeing universities build new athletic complexes, renovate existing learning halls, and build new spaces for students to gather on campus like student lounges, recreation centers, and dining facilities. Each project we’re seeing approved by school boards is aimed at improving the campus experience for enrolled students and making their university more attractive to prospective students.

Healthcare

For a few years, we’ve seen healthcare providers building new facilities closer to suburban areas and expanding their existing hospitals to better meet the needs of growing patient populations. Much like the push for freestanding emergency clinics in residential areas, we’re seeing increased development of standalone mental health clinics near populated areas. Part of the reason behind the growth is funding from the America Rescue Plan Act, which was allotted for improvements and new developments for mental health facilities. But, based on what we’ve heard from clients, another main factor in the renovations and new construction is a desire to change the outlook on these types of facilities and remove any stigma associated with seeking mental health treatment.

In the past, behavioral health clinics and facilities have had, or been perceived as, cold and institutional environments. Healthcare clients are working with design partners and contractors to ensure new projects have more natural light, friendlier environments, and brighter features while ensuring patient and staff safety remains paramount. We can expect to see a continued push for new mental health facilities within the healthcare market. The U.S. behavioral market is projected to be about $99 billion by 2028 — in 2021 the market was just under $78 billion.

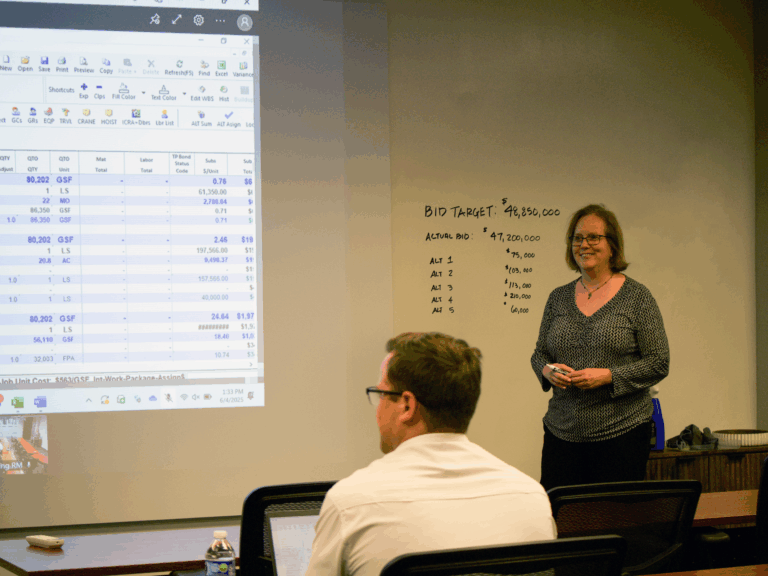

So, yes, construction costs are up because all costs are up, but the construction industry remains active in spite of these challenges — especially in markets that continue to be impacted by population growth and migration. Our industry has evolved and improved throughout the ongoing volatility in the supply chain. Mainly, we have proven the way to keep a budget reliable is to hire design teams, general contractors, and key trade partners as early in the design phase as possible. Early involvement, combined with significant planning and earlier decisions from clients is an effective tactic to overcome current supply and cost challenges. If we as an industry embrace and continue this collaborative approach to building, we can remain active and continue to develop the communities where we work and live.